Vitamins, nutritional, and herbal supplements for general health Some examples of common healthcare expenses that fall into this category are: Preventative care that is not doctor prescribed is not always HSA eligible. What common healthcare expenses are not HSA eligible? Teeth whitening is not covered, since it is considered a cosmetic dental procedure and not health related. This includes but is not limited to the following eight items:

HSA holders have the option to use their account for care given by an orthodontist, oral hygienists, dentist, or optometrist. What dental and vision expenses are covered for HSA holders? Medicare and other health coverage if you are 65 and olderĪn example of an insurance premium you cannot claim is Medicare supplemental insurance, such as Medigap.

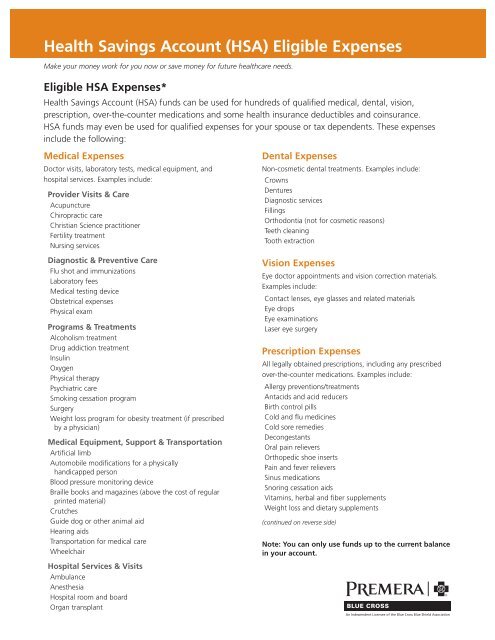

Healthcare coverage while receiving federal or state unemployment Healthcare continuation coverage (coverage under COBRA) You can only use your HSA to pay for insurance premiums if they fall into one of these four categories: For example, insurance premiums may not always be considered a qualified expense. All qualified medical expenses are not HSA eligible. These eight emergency medical expenses can also be covered by your HSA:Īre all qualified medical expenses HSA eligible? Your HSA can also reimburse you if you forget to use it to pay for these 12 expenses:Įmergencies will arise in everyone’s life. There are family-planning healthcare expenses that your HSA can also pay for. Prior to the expansion of HSA-eligible items under the CARES act, some of the most common expenses included:Ĭopays for prescriptions and office visitsĬommon healthcare expenses for families with young dependents include: That is why we have the most common HSA-expensed items split into four categories for you below. The area of healthcare that we spend the most money on depends on age, insurance coverage, location, and other variables. The cost of healthcare is steadily rising. These are the most common HSA-expensed items The following 18 items are examples of now-qualified medical expenses: The new items added were menstrual products and over-the-counter medications. The Coronavirus Aid, Relief, and Economic Security (CARES) Act also added some other medical expenses to the list. It also led to the following items qualifying as HSA-eligible expenses: This added personal protective gear used to prevent the spread of the coronavirus as qualified expenses. The IRS issued Announcement 2021-7 to help stop the spread of the coronavirus. The Internal Revenue Service (IRS) outlines qualified medical expenses in Publication 502, Medical and Dental Expenses. The main purpose of the expense must be to ease or prevent a physical or mental illness. What are qualified medical expenses?Įxpenses that qualify for the medical- and dental-expense deduction meet the criteria. Before you spend your HSA funds, you should check with your HSA administrator to make sure your expenses are eligible. You may also receive an HSA benefits card from your plan administrator to pay for eligible expenses. This will help you determine your HSA balance and allow you to view status updates for any expenses you’ve submitted. Make sure you log in and review your HSA account details frequently. As long as the money is used for eligible medical expenses, you won’t have to worry about paying taxes on the money later. If you contribute to your HSA with after-tax dollars, you’ll receive a deduction when you file your tax return. When you open an HSA, you typically contribute pretax dollars to the account.

HSA ELIGIBLE EXPENSES HOW TO

When you withdraw money from the account, you won’t have to pay taxes on the funds as long as they cover HSA-eligible expenses.īelow, we’ll explain how to use an HSA and provide you with 77 HSA-eligible expenses for 2022. Every dollar that you contribute to an HSA can pay for eligible medical expenses. You must have a high-deductible health plan (HDHP) to open an HSA. A health savings account (HSA) is a tax-exempt account set up to offset the cost of healthcare.

0 kommentar(er)

0 kommentar(er)